|

|

|

Tax Cheat Avoids $100 Million Penalty

Tax |

2007/03/28 19:02

|

Incorrectly worded Justice Department documents filed as part of the biggest tax prosecution ever will cause the federal government to miss out on $100 million. Telecommunications entrepreneur Walter Anderson, who admitted hiding hundreds of millions of dollars from the IRS and District of Columbia tax collectors, was sentenced Tuesday to nine years in prison and ordered to repay about $23 million to the city. But U.S. District Judge Paul Friedman said he couldn't order Anderson to repay the federal government $100 million to $175 million because the Justice Department's binding plea agreement with Anderson listed the wrong statute. Friedman said he could have worked around that problem by ordering Anderson to repay the money as part of his probation. But prosecutors omitted any discussion of probation - a common element of plea deals - from Anderson's paperwork. Channing Phillips, a spokesman for the U.S. attorney's office, which prosecuted the case in cooperation with Justice Department headquarters, said the government would bring civil charges against Anderson. That will require a new round of litigation in a court that does not wield the threat of more jail time. Prosecutors have said Anderson has money stashed away in accounts around the world, a claim Anderson denied in court. He appeared humbled but not overly apologetic Tuesday. He took responsibility for his actions but said he never intended to defraud the government. Anderson told the judge that his millions in unpaid taxes weren't funding an opulent lifestyle. He often used jets but for business or charity, he said, and usually he flew business class, not first class, and sometimes even coach. Anderson launched a long-distance telecommunications business in the 1980s as the industry was undergoing deregulation. When his first company, Mid-Atlantic Telecom, merged with another company in 1992, Anderson formed corporations in the British Virgin Islands to hide the income, prosecutors said. Authorities said Anderson used other offshore corporations to disguise his ownership in other telecommunications companies that earned more than $450 million between 1995 and 1999. He allegedly did not file federal income tax returns from 1987 to 1993. With credit for the two years he has been jailed, he will have to serve seven years in prison and will be eligible for release in less than six years. Among the taxes allegedly owed to the District of Columbia are use taxes, equivalent to sales taxes, on art, jewelry and wine. The indictment alleges that Anderson bought a painting by Salvador Dali and several paintings by Rene Magritte, an 18-karat gold bracelet and more than $47,000 in fine wines, then had them shipped to a Virginia address to avoid Washington taxes. |

|

|

|

|

|

|

Intel invests semiconductor plant in Vietnam

World Business News |

2007/03/28 18:44

|

Intel, the world's biggest chipmaker, started Wednesday construction of a chipset assembly and test facility with total investment of 1 billion U.S. dollars in southern Ho Chi Minh City, the first of its kind in Vietnam, according to local media on Thursday. When completed (scheduled in mid-2009), the facility will be the seventh assembly site of Intel's global network, and is projected to eventually employ some 4,000 local people, and generate annual revenues of 5 billion dollars, said Youth newspaper. Assembly and test facilities package chips that come from semiconductor fabrication plants. The assembly and test process can be broken down into three stages: packaging, testing and shipping. Vietnam is fostering high technologies, including information technology, in a move to realize the target of basically becoming an industrial country by 2020. Vietnam plans to have 38 million phone subscribers by the end of this year, or 43 units per 100 residents, up from 27.5 million subscribers by the end of last year. It also eyes 6 million Internet subscribers, by late 2007, up from over 4 million by late2006. Vietnam earned nearly 1.8 billion dollars from exporting electronics goods, including computers, mainly to Japan and Southeast Asian countries, in 2006, up 24 percent against 2005, according to the country's General Statistics Office. |

|

|

|

|

|

|

Samsung Unveils New Fusion Chip

World Business News |

2007/03/28 17:53

|

| Samsung Electronics, the world’s top maker of memory chips, Tuesday took the wraps off a third-generation fusion chip that is capable of running many applications and can be adjusted by manufacturers. The futuristic product, branded Flex-OneNand, was unveiled at the Samsung Mobile Solution Forum 2007 _ the fourth of its kind _ held in Taipei. "This kind of memory has never been seen before. Manufacturers of such items as cellular phones and consumer electronics will welcome it the most," Samsung President Hwang Chang-gyu said. "With our Flex-OneNand, for example, they will be able to come up with cheaper and slimmer products while offering more applications," said Hwang who leads the firm’s semiconductor unit. Flex-OneNand combines two memories and product manufacturers can adjust their capacity through dedicated software. Previously chip memories were either embedded or external. This is expected to sharply increase data throughput speeds and reduce the prices of handsets, portable game consoles and media players. "We are poised to roll out the Flex-OneNand in the second quarter of this year. Already big-name companies are ready to incorporate the item into their products," Hwang said. "Down the road, more advanced features will debut on the back of fusion memories including Flex-OneNand," the researcher-turned-chief executive said. Alongside the chips, Samsung also unveiled gigabyte solid-state disks and 8.4-million pixel CMOS image sensors at the forum. Hwang projected that fusion memories will become a mainstream component for portable consumer gadgets. "With the advent of the convergence era that blurs boundaries among conventional industries, we face the need to produce fusion chips encompassing as many applications as possible," Hwang said. "In the end, mobile handsets will be composed of just three parts: a display, battery and chip that includes memory, flash card and logic functions," he said. Hwang said Samsung aims to chalk up $10 billion in sales over the next five years from fusion chips alone, which he said are ready for prime time. Asked about the impact of the fusion chips, Hwang refused to make specific comments because Samsung’s customers are now developing customized products. |

|

|

|

|

|

|

Vonage: Overseas customers unaffected by litigation

Litigation |

2007/03/28 12:18

|

| Vonage customers overseas should not be affected by the Internet voice company’s recent legal troubles, according to a company spokesman. “We don’t anticipate any changes or interruptions in phone service as a result of this litigation, so we advise customers to continue using their service as they always have,” said John Yocca, Vonage public relations manager, in a written response to a query from Stars and Stripes. “There are many options available to us and we are prepared to implement them as necessary.” Rates for the Voice over Internet Protocol, or VoIP, technologies that allow consumers to make calls over the Internet aren’t expected to change, either, he added. Last week, a federal judge said he would issue an injunction barring Vonage Holdings Corp. from using Internet phone call technology patented by Verizon Communications Inc., but delayed signing the order for two weeks. Vonage currently offers service in the United States, Canada and United Kingdom, but Yocca said customers can take their Vonage devices anywhere in the world where VoIP is legal and a high-speed cable connection is available. Servicemembers arriving in South Korea before June 1 can continue using Vonage and other U.S. VoIP companies to make international phone calls. Those arriving in country after June 1 will be required to use a South Korean VoIP provider. |

|

|

|

|

|

|

Latham & Watkins Admits 5 New Partners Worldwide

Law Firm News |

2007/03/28 10:37

|

Latham & Watkins LLP1 is pleased to announce that five attorneys from four of the firm's departments across offices in the United States and Europe were elected to the firm's partnership, effective April 1, 2007. All five attorneys were previously of counsel with the firm. This year the firm has admitted 31 new partners worldwide.

"We extend our congratulations to each of these outstanding new partners," said Robert M. Dell, Chairman and Managing Partner of Latham & Watkins. "All have demonstrated impeccable client service, sound business judgment and strong technical expertise. Their election to the partnership recognizes their hard work, team play, commitment and valuable contributions to the firm." New Partners

Paris - Alexander Benedetti

Alexander Benedetti is a member of the Corporate Department. His practice focuses on private equity and mergers & acquisitions, with particular emphasis on LBOs. He regularly represents private equity institutions and equity sponsors in connection with leveraged buy-out acquisitions. Benedetti received a law degree in 1994 and a post graduate law degree in 1995 from the University of Aix-en-Provence in France. Los Angeles - Stacey L. Rosenberg

Stacey Rosenberg is a member of the Finance Department. Rosenberg has a broad finance practice and represents financial institutions, including commercial and investment banks, insurance companies and private investment funds. She has acted as counsel to the lead bank on large syndicated credits for both investment grade and highly-leveraged companies. Rosenberg also regularly represents equity sponsors in connection with financing for leveraged acquisitions and companies in connection with leveraged recapitalizations and ongoing financing needs. She is regularly involved in financing, co-production and distribution transactions for the motion picture, television, theater and related entertainment industries. Rosenberg received her J.D. from the University of California, Los Angeles in 1996. Brussels - Javier Ruiz Calzado

Javier Ruiz Calzado is a member of the Global Antitrust and Competition Practice and concentrates his practice on European Community (EC) and Spanish competition law, particularly in the area of cartel defense work and merger control. Prior to joining Latham, he served for six years as senior law clerk to Judge García-Valdecasas at the Court of First Instance of the European Communities (CFI). He played an active role in preparing the CFI's landmark judgments in leading cases in the field of competition, including Airtours/First Choice (one of the first ever annulments of a Commission merger decision) and Bayer-Adalat (a ground-breaking case interpreting the principle of unilateral conduct and the legality of parallel trade restrictions under EC competition rules). He received his J.D. from Universidad Autónoma de Barcelona in 1987 and his LL.M from the College of Europe in Bruges in 1988. He is fluent in English, French, Italian, Spanish and Catalan. Washington, D.C. - Susan E. Seabrook

Susan Seabrook is a member of the Tax Department, and practices tax controversy law analyzing federal tax issues and resolving tax controversies at all levels of tax administration. Before joining Latham, Seabrook served as an Attorney Advisor with the Internal Revenue Service's National Office of Chief Counsel, Financial Institutions and Products, Branch 4, where she had primary responsibility for technical advice memoranda, private letter rulings and published guidance. She also was tax counsel to the Life Insurance Industry Specialization Program. Seabrook currently serves as Vice Chair of the Insurance Companies Committee of the Tax Section of the ABA. Seabrook received her J.D. from Gonzaga University in 1985 and her LL.M from University of Denver in 1990. New York - Jeffrey A. Tochner

Jeffrey Tochner specializes in intellectual property and technology matters in the firm's Corporate Department and is the head of the Technology Transactions Practice Group in the firm's New York office. He is experienced in a wide variety of technology-related transactions including: outsourcing; joint ventures, strategic alliances and research and development; technology transfers; equipment manufacturing and installation agreements; software licensing and distribution; co-branding agreements; and e-commerce, internet and website agreements. He also routinely handles the intellectual property and technology aspects of mergers and acquisitions, as well as corporate finance transactions. Prior to joining Latham in 1997, Tochner served as a judicial clerk for the Honorable Emmett Ripley Cox, of the United States Court of Appeals, Eleventh Circuit. Tochner received his J.D. from the University of Florida in 1993. About Latham & Watkins

Latham & Watkins is a global law firm with more than 1,900 attorneys in 24 offices, including Barcelona, Brussels, Chicago, Frankfurt, Hamburg, Hong Kong, London, Los Angeles, Madrid, Milan, Moscow, Munich, New Jersey, New York, Northern Virginia, Orange County, Paris, San Diego, San Francisco, Shanghai, Silicon Valley, Singapore, Tokyo and Washington, D.C. For more information on Latham & Watkins, please visit the Web site at www.lw.com.

|

|

|

|

|

|

|

Law firm sues State Farm opponent Scruggs'

Insurance |

2007/03/28 09:16

|

| Jackson law firm has sued millionaire trial attorney Richard Scruggs for allegedly withholding money it claims it was owed for working on Hurricane Katrina insurance-related litigation. The lawsuit was filed March 15 in Lafayette County Circuit Court by Grady F. Tollison Jr. on behalf of the Jones, Funderburg, Sessums, Peterson & Lee law firm in Jackson. No court date has been set for the lawsuit. Tollison has requested a jury trial. Tollison was not in his office Tuesday and was not immediately available for comment. Scruggs is one of the nation's wealthiest trial attorneys. In the late 1990s, his Mississippi-based firm earned nearly $1 billion in fees for his part in reaching a landmark $250 billion settlement with tobacco companies. He used that windfall to finance lawsuits against insurance companies for denying thousands of policyholders' claims after Katrina destroyed their homes. Scruggs created a legal team, called the Scruggs Katrina Group, to represent the policyholders. SKG's work led to a settlement with State Farm Fire & Casualty Co. that will earn the attorneys about $26 million. Those legal fees are at the crux of the lawsuit. Zach Scruggs of Oxford, Scruggs' son and law partner, said Tuesday he could not immediately comment on the lawsuit. Also named as defendants in the lawsuit are other members of the SKG team. The lawsuit, which gives only one side of the legal argument, alleges that senior partner John G. Jones and other members of the Jackson law firm deposed witnesses, handled briefs, filed motions and other tasks for Scruggs' group. Specifically, the lawsuit mentions Jones and his law firm's work on a July 2006 lawsuit, filed by SKG on behalf of Pascagoula police officer Paul Leonard against Nationwide Mutual Insurance Co. over denial of Leonard's claim. Jones participated in the questioning of witnesses in that lawsuit. |

|

|

|

|

|

|

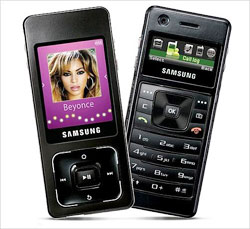

First look: Samsung's iPhone killer

Venture Business News |

2007/03/28 09:15

|

| Rather than waiting for Apple's iPhone, you might want to consider a rival you can buy sooner. Samsung's innovative, super-slim, two-faced UpStage (M620). On the eve of the giant CTIA Wireless trade show in Orlando, Florida, Sprint Nextel announced that it will begin selling the UpStage in the US on 1 April. Its price will be $300, or $150 with a two-year contract, Sprint representatives say. Unveiled in January at CES (the Consumer Electronics Show), the UpStage is a chocolate-bar style handset that's less than half an inch thick and not much taller or wider than an iPod nano. Other multimedia-friendly mobile phones struggle to balance the sometimes-conflicting requirements of a conventional handset and a music or video player. The UpStage solves this quandary by simply putting phone functions on one side of the device and the multimedia functions on the other. Face of a phone

The UpStage's phone face has a 1.4in sliver of a colour screen, a directional toggle and a keypad - one with soft, flat keys. The music-player/multimedia side features a 2.1in, 176-by-220-pixel display and a touch-sensitive navigation pad with a central button on the other. A small Flip button on the edge of the unit toggles between the two sides, but the prompt that confirms you want to stop playing music (on the music side of the phone) and make a phone call gets old pretty quick. The phone side will of course spring to life for incoming calls, halting music playback; the music resumes once you disengage the call. The UpStage felt small but solid in my hand; I found its keypad quite usable, and the sound quality on voice calls was generally good. The four-way touchpad on the music side has a central, mechanical play button that took some getting used to. The excellent documentation (including a printed manual of over 300 pages) warns against trying to swipe it in a circle the way you would an iPod's control wheel, but the temptation is hard to resist. It also took a while for me to stop trying to use the central button for directional navigation (instead of tapping the touchpad above, below, or to either side of the button). Switching sides

Even when the music/multimedia side is activated, you'll have to use the phone side whenever you need to input text - for example, to create a playlist, search the Sprint Store's music catalog or specify a URL for a site you wish to visit in the small-screen-optimised browser. I was a little confused the first time I encountered a text-input box on the music side, since no alphanumeric keys and no software keyboard appeared. But the device is smart enough to recognise the need to use the phone side, and I noticed that "Flip" had appeared on screen as a soft-key option. When I used it and began entering text from the phone keypad (T9 text input mode is a welcome option here), "Save/Flip" also appeared as a soft-key option to return me seamlessly to the multimedia side.

|

|

|

|

|

|

|

Class action or a representative action is a form of lawsuit in which a large group of people collectively bring a claim to court and/or in which a class of defendants is being sued. This form of collective lawsuit originated in the United States and is still predominantly a U.S. phenomenon, at least the U.S. variant of it. In the United States federal courts, class actions are governed by Federal Rules of Civil Procedure Rule. Since 1938, many states have adopted rules similar to the FRCP. However, some states like California have civil procedure systems which deviate significantly from the federal rules; the California Codes provide for four separate types of class actions. As a result, there are two separate treatises devoted solely to the complex topic of California class actions. Some states, such as Virginia, do not provide for any class actions, while others, such as New York, limit the types of claims that may be brought as class actions. They can construct your law firm a brand new website and help you redesign your existing law firm site to secure your place in the internet. |

Law Firm Directory

|

|